The astronomical rise of Bitcoin propelled more and more people to learn about cryptocurrencies.

In the beginning, there were only small retail investors adopting Bitcoin. Next large investors and institutions fell in love with it. Later came large corporations, and now cryptocurrencies have gone mainstream. It won’t be too long before governments and central banks adopt it also.

Investing legends like Paul Tudor Jones, Cathie Wood, and many Wall Street investors have become outspoken proponents of crypto investing. And recently, even companies such as Tesla or Microstrategy have become large Bitcoin investors.

Also, blockchain technology, which underpins most cryptocurrencies, is spreading rapidly. Numerous large banks and corporations have integrated blockchain tech into their businesses.

In short, crypto is here to stay.

That’s why we’ve put together this Splendid FX glossary of cryptocurrency terms. It is probably the most comprehensive and up-to-date glossary out there. It includes frequently used words as well as many technical phrases.

So, bookmark this page so that you can look it up here whenever you run across a complicated crypto term.

Here’s our most comprehensive list of cryptocurrency terms.

The Splendid FX Glossary of Cryptocurrency Terms

| 2-Factor Authentication (2FA) | 2-factor authentication (2FA) is a second method of verification, beyond your password, to make your trades and other transactions secure. There are multiple methods of 2FA, including pieces of hardware (see U2F, below) and software like Google Authenticator. Never enable text messages or phone calls as a method of 2FA. This is one of the worst possible security practices because hackers are very skilled at calling your phone company, convincing them that they’re you, and then using text-message or phone-call 2FA to access your accounts. |

| Address | Address is a long string of letters and numbers (in the case of Bitcoin, 26 to 35 characters) that represents a destination for one or more payments. The network ensures all addresses are unique. Payments received to an address are visible in the public ledger. |

| Airdrop | Airdrop is a cryptocurrency distributed for free based on some particular criteria. For example, to receive some airdrops, you had to prove you owned Bitcoin; how much you received was based on how much Bitcoin you owned. In other cases, airdropped coins are “earned” through tasks such as sharing news or downloading an app. Crypto projects use airdrops to generate interest in a new coin. |

| Altcoin | An altcoin is an abbreviation of “Bitcoin alternative.” Currently, most altcoins are forks of Bitcoin, with usually minor changes to the proof of work (POW) algorithm of the Bitcoin blockchain. The most prominent altcoin is Litecoin. Litecoin introduces modifications to the original Bitcoin protocol such as decreased block generation time, the increased maximum number of coins, and different hashing algorithm. |

| All-or-None (AON) Order | An all-or-none (AON) order will be filled only if it can be executed in its entirety; it’s like an FOK order, but without the time limit. This can be useful if you’re trying to ensure that you get a certain price point for all of a moderate-sized order. |

| All-Time High (ATH) | ATH is shorthand for all-time high, the highest price that an asset has ever had. A common fear in trading crypto is that FOMO will lead one to irrationally buy an asset at or near its ATH. |

| All-Time Low (ATL) | ATL is an acronym for all-time low, the lowest price that an asset has ever had. Traders often fear that emotional forces like FUD will lead them to sell off an asset at or near its ATL. |

| Arbitrage | Arbitrage is the strategy of profiting by simultaneously buying and selling an asset in order to take advantage of market inefficiencies by the same asset being priced differently in different places. Especially in this early stage of cryptocurrency’s history, where liquidity varies widely from one exchange to the next, there are numerous opportunities to exploit pricing differences between exchanges to profit through arbitrage. |

| Ask Price | The ask price for a given asset is the minimum price for which someone is willing to sell that asset. You can think of this as the “demand” side of “supply and demand.” |

| Atomic swap | Atomic swap is a trade of one cryptocurrency for another made outside of an exchange and without the use of a trusted third party. Instead, it uses the “smart contract” feature built into most cryptos to ensure each party receives their coins (and can’t cheat their counterparty). The Lightning Network is a platform that supports atomic swaps. |

| ASIC | Cryptocurrency addresses are used to send or receive transactions on the network. An address usually presents itself as a string of alphanumeric characters. |

| Bag holder | A bag holder is an informal term for someone who holds an asset that continually decreases in value, to the point of being worthless. In the cryptocurrency space, this term is sometimes used pejoratively to refer to people who continue to hold onto an asset due to faith alone, long after all indicators point to the unlikelihood of its value ever increasing. |

| Bear Trap | A bear trap is the opposite of a bull trap: It’s a false signal that a cryptocurrency’s price is about to fall, when it is actually about to rise. It can trick bearish investors into shorting the cryptocurrency or selling off their position in it. This often happens when it appears as if a cryptocurrency is about to break through a particular support level, but the support level ends up holding instead. |

| Bear Trend | A bear trend is a long-term decline in the overall cryptocurrency market. “Long-term” usually means at least a few months (e.g., the bear trend beginning in mid-January of this year), and is represented by indicators like a negatively sloped MA. |

| Bid Price | The bid price for a given asset is the maximum price that someone is willing to pay for that asset. You can think of this as the “demand” side of “supply and demand.” |

| Bid-Ask Spread | The bid-ask spread is the difference between the bid price and ask price for a given asset. This spread is the profit that market makers earn by buying and selling the asset on behalf of investors. As an asset’s liquidity increases, this spread decreases correspondingly. |

| Bitcoin (BTC) | Bitcoin (BTC), conceived in a white paper by Satoshi Nakamoto in 2008, was the first modern cryptocurrency that paved the way for the larger cryptocurrency ecosystem. It is still the largest cryptocurrency by market cap. Its primary use cases are as a form of digital currency and as a digital store of value. |

| Bitcoin Cash | Bitcoin Cash was created in 2017 by a hard fork of the original Bitcoin protocol. The main difference from the original Bitcoin is that it allows for larger-sized blocks in its blockchain (and thus for more transactions). Trades under the BCH ticker. |

| Bitcoin Core | The name for the full node software that runs the Bitcoin network. Has also become a nickname for the original Bitcoin in the wake of multiple hard forks that have created multiple versions of Bitcoin, including Bitcoin Gold, Bitcoin Diamond, and Bitcoin SV. |

| Bitcoin ETF | Bitcoin ETF is Bitcoin exchange-traded fund. A Bitcoin ETF will make it easier for both retail and institutional investors to invest in Bitcoin. Once the SEC approves the first Bitcoin ETF, other cryptocurrency-based ETFs are expected to follow. |

| Bitcoin SV | Bitcoin SV (BSV, “Satoshi Vision”) forked from Bitcoin Cash’s blockchain in November 2018. Its creation was the result of a disagreement over Bitcoin Cash’s direction: the Bitcoin SV developers believe that their version of the cryptocurrency best reflects Satoshi Nakamoto’s original vision of what Bitcoin should be, as outlined in the Bitcoin white paper, Nakamoto’s forum posts, and Nakamoto’s emails. Bitcoin SV rejected certain updates adopted by the main Bitcoin Cash chain, including the introduction of code supporting smart contracts and canonical transaction ordering. |

| Bitcoin.com | Bitcoin.com is a website run by Roger Ver that purports Bitcoin Cash is “the real Bitcoin” and sells both BCH and BTC. |

| Bitcoin.org | An open-source website created by Satoshi Nakamoto and maintained by the Bitcoin developers. It’s dedicated to raising awareness about Bitcoin as well as providing resources and information to general users. |

| Bitcoin/Crypto ATM | Bitcoin/Crypto ATM is a physical machine similar to a bank ATM where a person can exchange fiat money, such as U.S. dollars, for Bitcoin and sometimes other cryptocurrencies. Coin ATM Radar tracks the locations of crypto ATMs worldwide. |

| Black Swan | A black swan event is something that is virtually impossible to predict and has a huge impact on the market. A standard example of a black swan event was Zimbabwe’s peak inflation rate of almost 80 billion percent back in 2008. Part of responsible risk management in trading involves considering the possibility of these impossible-to-predict, marketwide changes — especially in an extremely volatile market such as crypto. Why call this kind of unpredictable event a “black swan”? It pays homage to the idiosyncratic history of humankind’s knowledge of swans. Back in the 2nd century, the Roman poet Juvenal coined the phrase “rara avis in terris nigroque simillima cygno” to identify something as impossible. In English, this means “a rare bird in the lands and very much like a black swan” — a bird that, at the time, was thought to not exist. 17th-century Europeans commonly used this phrase to call something out as impossible — until, that is, Willem de Vlamingh and his team of Dutch explorers discovered black swans in Western Australia in 1697. No longer was the black swan a symbol of impossibility: instead, it evolved into a symbol of something seemingly impossible that could later become a reality. Nassim Nicholas Taleb popularized the term’s use with regard to financial markets in his 2001 book, Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets. |

| Block | Blocks are packages of data that carry permanently recorded data on the blockchain network. |

| Block height | Block hight in a blockchain, means that as the blocks are created sequentially, each block is assigned a number according to its place in the chain. Events like forkscan be scheduled to occur at a particular block height, such as 478,559. |

| Block Reward | When a block is successfully mined on the bitcoin network, there is a block reward that helps incentivize miners to secure the network. The block reward is part of a “coinbase” transaction which may also include transaction fees. The block rewards halves roughly every four years; see also “halving.” |

| Block size controversy | Block size controversy is fight within the Bitcoin community that raged from 2015-2017. One side wished to keep the size of the blocks at 1 megabyte; the other felt that the block size needed to increase to accommodate scaling of the network. The fight ended with the fork of Bitcoin Cash, giving each side the version of Bitcoin it desired. Later, the Bitcoin Cash group had its own split over further increases to the block size, creating Bitcoin SV (Satoshi’s Vision) in November 2018. |

| Blockchain | Blockchain is the public digital ledger of all of a cryptocurrency’s transactions, made up of individual blocks of data created either through mining or another process. It secures the transactions on the network and prevents double spending. |

| Blockchain-as-a-service | Blockcahin-as-a-service is a cloud-based service, based on blockchain technology, offered by a company, usually to other companies. Both IBM and Microsoft have blockchain-as-a-service products. |

| Bollinger Bands | Bollinger Bands — named after their developer, trader John Bollinger — are the lines two standard deviations above and below an asset’s simple moving average. They’re commonly used as indicators in technical analysis: · When an asset is trading near its upper Bollinger Band, it’s considered overbought. · When an asset is trading near its lower Bollinger Band, it’s considered oversold. · When an asset’s Bollinger Bands are close together (a “squeeze”), it’s thought to be likely that the asset’s price will become more volatile in the future. · When an asset’s Bollinger Bands are far apart, it’s thought to be likely that the asset’s price will become less volatile in the future. · When an asset is trading near its lower Bollinger Band, it’s considered oversold. · When an asset’s Bollinger Bands are close together (a “squeeze”), it’s thought to be likely that the asset’s price will become more volatile in the future. · When an asset’s Bollinger Bands are close together (a “squeeze”), it’s thought to be likely that the asset’s price will become more volatile in the future. · When an asset’s Bollinger Bands are far apart, it’s thought to be likely that the asset’s price will become less volatile in the future. |

| Bull Trap | A bull trap is a false signal that a cryptocurrency’s price is about to rise, when it is actually about to fall. It gets its name from the fact that it ends up trapping bullish traders in bad trades. A typical example of a bull trap is when a cryptocurrency looks like it is about to break through a certain resistance level but subsequently fails to do so. |

| Bull Trend | A bull trend is a long-term, upward trend in the overall cryptocurrency market. How different people specifically define it varies, but it’s typically on the order of months or years rather than days or weeks, and it’s associated with indicators like a positively sloped moving average (MA). |

| Buterin, Vitalik | Vitalik Buterin is the Russian-Canadian computer programmer who created Ethereum. He remains one of the most prominent figures in the cryptocurrency community. |

| Buy the Dips | “Buy the dips” is a motto reflecting the philosophy that one should buy a cryptocurrency when its price has significantly dropped, with the expectation that it will bounce back eventually (especially if the cryptocurrency has compelling underlying value). It’s the second half of Warren Buffett’s timeless advice: “Be fearful when others are greedy, and greedy when others are fearful.” |

| Buy Wall | A buy wall is basically the opposite of a sell wall: a large number of buy orders, typically placed on the order book all at once. There are at least a couple of reasons why HNWIs would put up a sell wall. One is to ensure that the cryptocurrency’s price doesn’t drop below the position of the sell wall (since anyone else who wants to buy the cryptocurrency quickly will have to execute their trade at a price higher than that of the sell wall). Another is to try to drive the cryptocurrency’s price up before the HNWIs sell some or all of their position in it. |

| Candlesticks | Candlesticks are a graphical representation of an asset’s trading history. They’re often used in technical analysis because the shapes of candles are thought to be useful indicators of where an asset’s price might be heading next. Different candlestick charts use candlesticks to represent different amounts of time. For instance, on a 1-hour candlestick chart, each candlestick represents a trading period of 1 hour, whereas the candlesticks on a 15-minute chart represent trading periods of 15 minutes. The color of a candle indicates whether the asset closed at a higher or lower price than its open price for the period of time that the candle represents: A “bullish” green candle indicates that the asset closed higher than it opened, and vice versa for “bearish” red candles. The top and bottom of a candle’s true body indicate the open and close prices of the asset. The top of a bullish candle is the price at which it closed the period, and its bottom is the price at which it opened the period; vice versa for bearish candles. A candle’s shadows — the lines protruding from the top and bottom of its true body — indicate the maximum and minimum price of the asset during the candle’s period. |

| Casper | Casper is a protected and reliable utility for DApp based on Ethereum platform. It is the fastest way to ensure your DApp stores data, i.e., video, photo, audio, text, databases. It is implemented by joint effort of a variety of vendors, which provide their hard drives and internet-channels for storing and transferring your files. They will rent their facilities in exchange for monthly reward, such as tokens. Vendors may choose to become local data centers, which will ensure a higher access rate and low response time for all users, both individual and companies. |

| Chaincode | Chaincode is a program, written in Go, node.js, and eventually in other programming languages such as Java, that implements a prescribed interface. |

| Circulating supply | An approximation of the number of coins or tokens that are circulating in the public market. See also: total supply and maximum supply. |

| Cloud mining | Cloud mining is the purchase or rental of a set amount of crypto mining poweroperated by another (typically a commercial enterprise such as Genesis Mining.) In this way, a person can mine crypto without owning or operating any mining equipment themselves. |

| Coin | A coin is a unit of digital value. When describing cryptocurrencies, they are built using the bitcoin technology and have no other value unlike tokens which have the potential of software being built with them. |

| Cold Storage | The term cold storage is a general term for different ways of securing your bitcoins offline (disconnected from the internet). This would be the opposite of a hot wallet or hosted wallet, which is connected to the web for day-to-day transactions. The purpose of using cold storage is to minimize the chances of your bitcoins being stolen from a malicious hacker and is commonly used for larger sums of bitcoins. |

| Cold Storage | Cold storage is any kind of cryptocurrency wallet that is offline — e.g., a paper wallet or hardware wallet that is not connected to the internet. They’re thought to be especially secure because your private keys are kept away from places where hackers or other entities can find them. But they can also be harder to recover if you forget or lose your information (since, oftentimes, no one else has that information). |

| Confluence | Confluence is the presence of multiple indicators or analytical methods all indicating the same upcoming movement in an asset’s price. This is a way of mitigating trading risk by waiting for multiple signals all forecasting the same thing, rather than just trading on the basis of a single indicator. |

| Consensus | Consensus on a crypto network, a condition in which all the participants (nodesand miners) agree on the order of the blocks in the blockchain as well as the veracity of the transactions contained in those blocks. This the “normal” state of a properly functioning crypto network. |

| Contagion | Contagion refers to a disturbance that spreads from one market to another and has the potential to disrupt trading strategies that focus too heavily on market correlations. For example, one might try to profit by watching a pair of tightly correlated cryptocurrencies, waiting for one of them to have a disproportionately low price, and then buying that disproportionately cheap cryptocurrency, with the expectation that its price will rise and restore the correlation between the pair. But if this is a case of contagion, the entire crypto market might be heading for a dip, meaning that one will have lost money by taking a long position on the disproportionately cheap cryptocurrency. |

| Cryptoasset | Cryptoassets are assets in the form of a digital token, secured by cryptography and built on blockchain technology. The term refers to the token itself rather than the software upon which it is built. For example, Ethereum’s cryptoasset is ether (ETH). In some cases, including Bitcoin, the software and the cryptoasset bear the same name — for those currencies, you can distinguish between them because the name of the software is capitalized (“Bitcoin”) while the cryptoasset is written in all lowercase (“bitcoin,” or “BTC”). |

| Cryptocurrency | Cryptocurrency is digital medium of exchange secured by strong cryptography. |

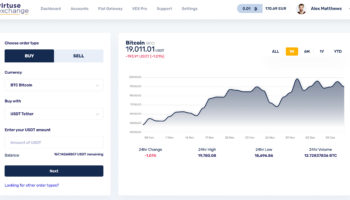

| Cryptocurrency exchange | Crypto exchange is a business that facilitates the trading of cryptocurrencies for fiat money (such as U.S. dollars), as well as trading between cryptocurrency pairs. |

| Dapp: decentralized application | Dapp is a kind of application that runs on a distributed, decentralized network, such as the Ethereum network, rather than a device such as a smartphone or PC. The best-known example is Cryptokitties. |

| Day Trading | Day trading is like swing trading but with a higher trade frequency. As the name suggests, day traders trade multiple times per day, typically trying to routinely profit from small fluctuations in a market. |

| Decentralization | Decentralization is the concept of having no central authority in control of a blockchain (other than the code that governs the system) as well as having dispersed infrastructure (nodes and miners) to prevent having a single point of failure. |

| Decentralized | Cryptocurrencies use decentralized control as opposed to centralized electronic money and central banking systems. The decentralized control of each cryptocurrency works through a blockchain, which is a public transaction database, functioning as a distributed ledger. |

| Decentralized applications (dApps) | For an application to be considered a Dapp or decentralized application it must meet the following criteria (1) Application must be completely open-source, it must operate autonomously, and with no entity controlling the majority of its tokens. The application may adapt its protocol in response to proposed improvements and market feedback, but all changes must be decided by consensus of its users. (2) Application data and records of operation must be cryptographically stored in a public, decentralized blockchain in order to avoid any central points of failure. (3) The application must use a cryptographic token (bitcoin or a token native to its system) which is necessary for access to the application, and any contribution of value from miners/farmers should be rewarded with the application’s tokens. (4) The application must generate tokens according to a standard cryptographic algorithm acting as a proof of the value nodes are contributing to the application (Bitcoin uses the Proof of Work Algorithm) |

| Deflationary | Deflationary is a condition in which a currency gains value (i.e., buying power) over time. Some cryptocurrencies, most notably Bitcoin, are designed to be deflationary by gradually constricting the supply until it reaches a hard cap, after which no more coins will be created. |

| Depth | Depth refers to the ability of a market for a specific asset to sustain large orders of that asset without the asset’s price moving significantly. The more open limit orders there are on both sides of an exchange’s order book for an asset, the more depth that book has. Depth is also closely tied to liquidity: The more depth an order book for an asset has, the more liquidity the order book provides to that asset. Depth charts graphically represent the depth of order books, showing the volume of open orders at various price points and illuminating phenomena like buy walls and sell walls. |

| Difficulty | Difficulty on a proof-of-work network like Bitcoin’s is a number representing how much mining power (hashrate) is required to solve a block. The Bitcoin network adjusts the difficulty every 2,016 blocks to try to keep the rate of new blocks steady at one every 10 minutes. As more mining power is added to the network, the difficulty rises. If mining power leaves the network, the difficulty falls. |

| Digital asset | Digital asset is digitally stored content or an online account owned by an individual. |

| Digital commodity | Digital commodity is a scarce, electronically transferrable, intangible, with a market value. |

| Digital identity | A digital identity is an online or networked identity adopted or claimed in cyberspace by an individual, organization, or electronic device. |

| Digital Signature | A digital code generated by public key encryption that is attached to an electronically transmitted document to verify its contents and the sender’s identity. |

| Distributed Ledger | Distributed ledgers are ledgers in which data is stored across a network of decentralized nodes. A distributed ledger does not have to have its own currency and may be permissioned and private. |

| Distributed Network | A type of network where processing power and data are spread over the nodes rather than having a centralised data centre. |

| Diversification | Generally speaking, diversification is a method of managing the overall level of risk in your portfolio by investing in a range of assets that aren’t perfectly correlated with each other, securing better profits (on average), and minimizing the risk of losses. It can be hard to diversify within the crypto sector at this early stage of its existence, but there are a few rules of thumb that are good to follow: · Use Bitcoin as the foundation of your crypto holdings. As the cryptocurrency with the biggest market cap, Bitcoin is almost like an index fund for the crypto sector: if crypto as a whole succeeds, then Bitcoin will succeed. · Holding Ether is a good way of betting that blockchain will have applications beyond being a mere store of value, since most other use cases are being built on Ethereum in one way or another. · Holding Bitcoin Cash is a good way of investing in the use of cryptocurrencies in commerce. |

| Dollar-Cost Averaging | Dollar-cost averaging is the strategy of buying a particular dollar amount of an asset on a regular schedule, e.g., X amount every hour or X amount every day. The idea behind this strategy, which plays well with HODLing, is to gradually take on a position in an asset like Bitcoin in a way that resists the short-term swings of the market. |

| Dust | Dust very tiny transactions (remember, cryptocurrency can be divided into multiple decimal places) that can clog up a network in large numbers. On networks with fluctuating fees, such as Bitcoin‘s, the cost to move a dust transaction sometimes can exceed the value of the dust itself. Users should try to consolidate their dust when fees are low. |

| Encryption | Encryption is the process of turning a clear-text message (plaintext) into a data stream (cipher-text), which looks like a meaningless and random sequence of bits. |

| ERC-20 | ERC=20 is a standard for building new cryptocurrency tokens based on the Ethereum network, ERC-20 tokens are created via Ethereum’s smart contractcapabilities. Most ICOs have been ERC-20 tokens. |

| Ether | Ethereum is a blockchain-based decentralised platform for apps that run smart contracts, and is aimed at solving issues associated with censorship, fraud and third party interference. |

| Ethereum | Ethereum (ETH), the second-largest cryptocurrency by market cap, was proposed by Vitalik Buterin in a 2013 white paper. This blockchain is intended to function as a kind of global, decentralized computer, with a Turing-complete programming language and a layer of smart contracts that allow developers to create everything from decentralized applications to tokens powering ICOs. |

| Ethereum Classic | Ethereum Classic was created in the wake of the DAO hack, which resulted in the theft of 3.6 million ETH. While the majority of Ethereum stakeholders voted to rewrite the blockchain to erase the results of the hack, a vocal minority argued that doing so would undermine the entire concept of blockchain by violating its immutability. This minority refused to accept the revised code and became the Ethereum Classic currency. From these beginnings, Ethereum Classic has developed into something like a more conservative version of Ethereum, focused on immutability above all else. |

| Exchanges | An exchange is a marketplace where people are able to buy and sell assets. The New York Stock Exchange (NYSE), for example, is a place where people are able to buy and sell stocks. There are a number of cryptocurrency exchanges set up today and that number is increasing all the time. Some of the major exchanges include: · Kraken, headquartered in San Fransisco, CA, · Gemini, headquartered in New York, NY, · Bitstamp, headquartered in Luxembourg, · Bitfinex, headquartered in Hong Kong, · Binance, headquartered in Malta. All cryptocurrency exchanges are not created equal. Different exchanges let you buy and sell different cryptocurrencies; different exchanges set different prices for their listed cryptocurrencies; and different exchanges have different volumes of trades happening on them, which changes how easy it is to buy or sell cryptocurrency efficiently. · Gemini, headquartered in New York, NY · Bitstamp, headquartered in Luxembourg · Bitfinex, headquartered in Hong Kong · Binance, headquartered in Malta All cryptocurrency exchanges are not created equal. Different exchanges let you buy and sell different cryptocurrencies; different exchanges set different prices for their listed cryptocurrencies; and different exchanges have different volumes of trades happening on them, which changes how easy it is to buy or sell cryptocurrency efficiently. |

| Faucet | Faucet is a website that dispenses tiny amounts of cryptocurrency for free. Visitors earn crypto by playing simple games or performing some other task such as watching videos. Generally not worth the time or the effort. |

| Fiat | Fiat refers to government-issued currencies, such as the U.S. dollar, the euro, and the renminbi. These typically are contrasted with cryptocurrencies, although those two categories are beginning to blur as many governments plan to issue their own cryptocurrencies. |

| Fiat currency | Fiat currency is money created by a central bank, such as the U.S. Federal Reserve (U.S. dollar) or the Bank of England (pound sterling). Many cryptocurrency enthusiasts believe fiat currencies will someday fail and be replaced by crypto. |

| Fill-or-Kill (FOK) Order | A fill-or-kill (FOK) order is similar to an IOC order, except it cannot be partially filled: It must be filled in its entirety immediately; otherwise, it is cancelled. If you’re trying to execute a large order on multiple exchanges, this is a good way to test the order on all of those exchanges to see if it goes through, without needing to manually cancel the orders that aren’t immediately filled. |

| Flippening | Flippening is the unseating of Bitcoin as the dominant cryptocurrency by another crypto. The term became popular in mid-2017, when Ethereum‘s percentage of the combined market capitalization of all cryptocurrencies rose to within seven percentage points of Bitcoin’s. |

| Flipping | A type of investment strategy (popular in real estate investing) where you buy something with the goal of reselling for a profit later, usually in a short period of time. In the context of ICOs, flipping refers to the strategy of investing in tokens before they are listed on the exchanges and reselling them for a profit when they are trading in the secondary market. |

| FOMO | Fear of missing out (“FOMO”) is modern slang for a timeless, irrational behaviour: worrying that you’re missing out on a great opportunity and therefore jumping into an investment. In the cryptocurrency space, otherwise inexplicable influxes of buyers have been attributed to FOMO. |

| Fork | Fork changes to the software that runs a blockchain – the software run by miners and people operating nodes – that creates a new version of the cryptocurrency. Soft forks tend to be benign, either used to launch a new crypto project (for example, Charlie Lee used Bitcoin’s codebase to create Litecoin) or to fix errors in a cryptocurrency’s codebase (no new crypto is created). A hard forkusually creates a new, competing version of a cryptocurrency, such as the Bitcoin Cash fork from Bitcoin. In a hard fork, the resulting two cryptos share a common transaction history prior to the fork. In addition, people who hold any amount of that crypto before a hard fork own equal amounts of both after the hard fork. |

| FUD | Fear, uncertainty, and doubt (“FUD”) is modern slang for the “opposite” of FOMO: irrationally worrying that a particular investment or sector might collapse. In the cryptocurrency space, otherwise inexplicable sell-offs have been attributed to FUD. |

| Full node | A full node is a node that fully enforces all of the rules of the blockchain |

| Fundamental Analysis (FA) | Fundamental analysis (FA) is a trading strategy that emphasizes trading based on the intrinsic value of the asset. Traders consider a wide range of quantitative and qualitative data in an attempt to determine this intrinsic value. Especially in these early days of crypto, a lot of fundamental analysis amounts to trying to determine which cryptocurrencies have compelling long-term value propositions rather than being mere get-rich-quick schemes. |

| Gas | Gas is a unit of measuring the computational work of running transactions or smart contracts in the Ethereum network. This system is similar to the use of kilowatts (kW) for measuring electricity in your house; the electricity you use isn’t measured in dollars and cents but instead through kWH or Kilowatts per hour. |

| Gas limit | Gas limit refers to the maximum amount of gas you’re willing to spend on a particular transaction. A higher gas limits mean that more computational work must be done to execute the smart contract. A standard ETH transfer requires a gas limit of 21,000 units of gas. |

| Gas price | Gas price refers to an internal price that is paid for running a transaction or a contract on the Ethereum network. |

| Genesis block | Genesis block is the very first block of data created in a blockchain. |

| Github | GitHub is a web-based version-control and collaboration platform for software developers. |

| Going Long | Going long on a cryptocurrency means that you’re buying it with the expectation of selling it at a higher price (without hedging). It doesn’t necessarily mean that you’ll be holding your position for a long time, though: Day traders “go long” when they buy a stock and sell it for a higher price an hour later. |

| Going Short | Going short on a cryptocurrency is a way of profiting by betting that its price will go down. There are two standard ways to short an asset: 1. Buy put options on the cryptocurrency: an agreement allowing one to sell a certain amount of that cryptocurrency at an agreed-upon price, which appreciates as the cryptocurrency depreciates. 2. Borrow a certain amount of the cryptocurrency from a broker, immediately sell it, and then later buy back the same amount of that asset — hopefully at a lower price — to repay the broker. This is inherently quite risky since there’s no limit to how much money you can end up owing the broker if the asset goes up in value after your initial sale, rather than down. A less risky way of pseudo-shorting a cryptocurrency is to sell off a certain amount of your own holdings in the cryptocurrency, with the expectation that the price will drop, and then buy more of the cryptocurrency at the reduced price. Notice, though, that this isn’t quite the same as what we discussed above. For this strategy to work, you’re not just betting that the cryptocurrency’s price is going down; you’re also betting that it’s going to come back up. |

| Gorilla Trades | Gorilla trade are designed for executing large trades without inadvertently moving the market. This method of trade finds the best way to execute a large order by only showing smaller pieces of it on the order book, preventing it from getting buried deep in the order book. It’s best used when there are medium levels of activity in the market. |

| Gwei | Gwei is a denomination of ether (ETH), the cryptocoin used on the the Ethereum network. |

| Halving or halvening | Halving is an event in which the block reward given to miners for solving a block is cut in half. Bitcoin has had two halving events so far. The first reduced the mining reward from 50 bitcoins to 25; the second reduced it to 12.5 bitcoins. Only applies to cryptos that use proof of work (POW) system. |

| Hard cap | A hard cap is the absolute upper limit a team will take in a fundrasing goal |

| Hard fork | A type of fork that renders previously invalid transactions valid, and vice versa. This type of fork requires all nodes and users to upgrade to the latest version of the protocol software. |

| Hardware Wallet | A hardware wallet is a unit of security-audited hardware that stores your private keys and allows you to send, receive, and store cryptocurrency. They’re thought to be some of the most reliable, safest storage solutions available. At the moment, Trezor and Ledger are the leading hardware wallets out there. |

| Hash rate | Hash rate is the speed at which a computing device (e.g., mining hardware) can convert a set of data into a “hash” – an alphanumeric string of characters. It’s described in hashes per second. So a “megahash” is 1 million hashes per second, and a “gigahash” is 1 billion hashes per second. The power of mining hardware is determined by its hash rate – the higher the better. The higher the hash rate of your mining equipment, the more likely you are to solve a block and receive the block reward. |

| Hashcash | Hashcash is a proof-of-work system used to limit email spam and denial-of-service attacks, and more recently has become known for its use in bitcoin (and other cryptocurrencies) as part of the mining algorithm. |

| Hedging | Hedging is an action you take to mitigate the risk of a trade. For example, if Bitcoin’s candlestick chart is suggesting that the market is very indecisive, and you think the price is about to go up, you might buy some more BTC while simultaneously shorting a correlated asset (e.g., ETH). Neglecting to hedge is one of the easiest ways to overexpose yourself to risk — especially if you’re day trading. |

| High-Net-Worth Individual (HNWI) | A high-net-worth individual (HNWI), broadly speaking, is a person who trades large enough amounts of an asset that the trades can move the market for that asset. HNWIs can be formally defined in a number of ways, but a common method of identifying them is seeing whether they qualify as an accredited investor: a person or entity who, according to the SEC under Regulation D, has a reduced need for the protection of regulatory disclosure filings due to this person or entity’s financial sophistication. If you’re a person, you qualify as an accredited investor if you meet one or more of these conditions: · You’ve had an annual income of $200,000, or $300,000 jointly with a spouse, for the last 2 years, with expectations of that income continuing · You have a net worth of $1 million or more, either individually or jointly with a spouse · You’re an executive officer, general partner, or director for an issuer of unregulated securities An entity is an accredited investor if it consists of people who are accredited investors, or if it’s a private business development organization or company with assets in excess of $5 million. |

| HODL | HODL: verb A misspelling of “hold” that evolved into a shortened form of “Hold On for Dear Life”.

After buying crypto, a person who is HODLing intends to keep it even as prices go up and down. Originally a misspelling of “hold”, HODL became a popular term among those who buy cryptocurrencies. A person who does this is known as a “HODLer” or “HODLER”. |

| Hot Storage | Hot storage is any kind of cryptocurrency wallet that is connected to the internet — for example, a web wallet or mobile wallet. They are typically thought to be the least safe wallets because they are susceptible to hacks, though they’re also usually easier to recover than cold-storage wallets if you forget your password — provided that the company providing the wallet also provides a password reset option. |

| Hot wallet or hot storage | Hot wallet is a cryptocurrency wallet connected to other networks or the Internet, and thus considered more vulnerable to hackers. |

| Howey test | Howey is a test created in 1946 by the Supreme Court to determine if an investment fits the definition of a security. Using the Howey Test, the SEC views most Initial Coin Offerings as securities – meaning they were sold to the public illegally. The criteria are: 1) whether money was invested; 2) whether the investor has an expectation of profits; 3) whether the invested funds are pooled in a common enterprise; and 4) whether any profits made derive from efforts and operations outside the investor’s control. |

| Iceberg Order | An iceberg order is a very large order that’s been divided into a large number of smaller limit orders in order to hide the overall quantity being bought or sold, with the hope of avoiding moving the market with your trade. It’s called an iceberg because the amount of crypto you see in the order is just the tip of the iceberg. |

| Immediate-or-Cancel (IOC) Order | An immediate-or-cancel (IOC) order must be filled immediately, and any portion of it that cannot be filled immediately is cancelled. If you think the crypto market is just about to dip, and you want to get as much of your BTC stack as possible out right now, before the dip, this order type is a natural choice. |

| Initial coin offering (ICO) | ICOs are types of crowdfunding mechanisms conducted on the blockchain. Originally, the main idea of an ICO was to fund new projects by pre-selling coins/tokens to investors interested in the project. Entrepreneurs present a whitepaper describing the business model and the technical specifications of a project before the ICO. They lay out a timeline for the project and set a target budget where they describe the future funds spending (marketing, R&D, etc.) as well as coin distribution (how many coins are they going to keep for themselves, token supply, etc.). During the crowdfunding campaign, investors purchase tokens with already established cryptocurrencies like Bitcoin and Ethereum. |

| Lambo | Short for the Italian luxury sports car brand Lamborghini. Another way of expressing optimism that a cryptocurrency owner will gain enough wealth from rising crypto prices to afford such a car. Often expressed as “When Lambo?” (See moon.) |

| Ledger | is an append-only record store, where records are immutable and may hold more general information than financial records. |

| Lee, Charlie | Lee is the computer scientist responsible for the creation of Litecoin, which he based on the open-source Bitcoin code. His brother, Bobby Lee, founded the Chinese cryptocurrency exchange BTC China. |

| Leverage | Leverage is the additional buying power created by margin trading, allowing you to effectively pay less than full price for an asset using borrowed funds. Leverage is typically represented as a ratio: for example, if you have $10,000 in a trading account and borrow another $10,000, then you have 2:1 leverage. |

| Lightning Network | A low latency, off chain P2P system for making micropayments of cryptocurrencies. It offers features such as instant payments, scalability, low cost and cross-chain functionality. Participants do not have to make individual transactions public on the blockchain and security is enforced by smart contracts. |

| Lightning Network | Lightning Network is a second layer on top of a blockchain network that enables near-instant, low-cost, secure transactions by creating payment “channels.” Plans are for the fully developed networks to allow for millions of transactions per second (a credit card system like Visa can process 45,000 per second). When fully developed and deployed, Lightning will solve Bitcoin‘s scaling issues. Lightning also facilitates atomic swaps between different cryptocurrencies. |

| Limit Order | A limit order is an agreement that you make with an exchange to execute a trade only at a certain price point or better. If that price point ends up never being reached, your order may never be executed. Limit orders also allow you to set a time limit on the order, after which the trade won’t be executed at all. |

| Liquidity | Liquidity, roughly speaking, is a measure of how easy it is to convert an asset into cash quickly and without loss. The easier this is, the more liquid an asset is. One facilitator of liquidity in the cryptocurrency trading world is the presence of many different limit orders creating depth in an exchange’s order book. |

| Litecoin | Litecoin (LTC) is a “clone” of Bitcoin released in 2011 by Charles Lee, but with a larger pool of total coins, shorter block processing times, and a different hashing algorithm. Lee believed that BTC was better suited to be a store of value, like gold, rather than a true currency. He created LTC to be the digital equivalent of silver: it’s in the same asset class as Bitcoin’s digital gold, but LTC is designed to be less valuable and easier to transact with. |

| Margin Trading | Margin trading is the practice of buying an asset using funds borrowed from a broker. This is a risky method of trading because, if the assets end up decreasing in value, the trader can be left in significant debt — it’s possible to lose more money than one initially invested. |

| Market cap | Market Cap is the amount of Fiat money (USD, GBP etc) currently invested into a Cryptocurrency. |

| Market Makers | Contrary to some increasingly common colloquial uses of the term, a “market maker” is not someone who is rich enough to move the entire market with their trades. Rather, a market maker is an entity who provides liquidity to an exchange by placing limit orders on its order book so that trades can be made at a range of prices. Many exchanges provide rebates to makers for this added liquidity. |

| Market Order | A market order is what happens when you make an agreement with an exchange to buy or sell a certain amount of an asset immediately at the best available price. Depending on the size of your order and the trading volume on the exchange, this can end up giving you an extremely suboptimal price, though it allows you to execute your trade quickly. |

| Maximalist | Maximalist is a person who believes in the primacy of one cryptocurrency over all others. Most frequently applied to adamant Bitcoin advocates: “He’s such a Bitcoin maximalist.” |

| Mining | Mining is the process of using hash rate power to solve a math problem, then verifying the most current transactions and adding a block of data to that cryptocurrency’s blockchain. Mining is used in cryptocurrencies that employ proof of work, such as Bitcoin. The miner that solves the block receives a mining reward of a set amount of the cryptocurrency being mined. Mining success depends on having hardware with a high combined hash rate. |

| Monero | Monero is cryptocurrency designed with a focus on privacy features. It’s extremely difficult, if not impossible, to trace transactions on the Monero network. |

| Moon | In crypto slang, “moon” has multiple connotations. Most simply, a cryptocurrency going “to the moon” refers to its price skyrocketing, either in the short-term because of some kind of announcement/market sentiment, or in the long-term because of the cryptocurrency’s real value. “Moon lambos” are the lavish cars that some intend to buy once their crypto holdings go to the moon. They are not Lamborghinis that one drives on the moon. Sometimes, though, there’s also a bit of derisiveness behind the use of the term “moon”: It can be used to refer to people who are undereducated about the crypto space and are merely buying up coins with the expectation of making a quick, huge profit. This kind of subtle mockery is typically what’s happening when people post “when moon?” on crypto traders’ discussion forums. |

| Moving Average (MA) | A moving average is a method used in technical analysis to smooth out smaller fluctuations in an asset’s price: It’s the average price of an asset over a number of periods of a given length. Moving averages come in different varieties, but the most common types are the exponential moving average, which determines the average price of an asset while giving more weight to more recent prices, and the simple moving average, which determines the average price of an asset without any time bias. |

| Mt. Gox | In Bitcoin’s early days, Tokyo-based Mt. Gox was by far the biggest exchange, handling more than 70% of all trading. The name is actually an acronym for Magic the Gathering Online Exchange, as it had started out as a way to trade the digital playing cards for that well-known game. But the exchange was poorly run and subject to hacks – hacks that depleted its reserve of bitcoins. Mt. Gox went dark in February 2014, and days later reported the loss of 850,000 customer bitcoins. About 200,000 bitcoins were later found. But with the case moving slowly through the Japanese legal system, former customers have so far received no compensation. |

| Multi-signature (multisig) | Multi-signature (multisig) addresses allow multiple parties to require more than one key to authorize a transaction. The needed number of signatures is agreed at the creation of the address. Multi signature addresses have a much greater resistance to theft. |

| Nakamoto, Satoshi | Satoshi Nakamoto is the pseudonym used by the person or group of people who wrote the Bitcoin white paper as well as the original code that runs the Bitcoin network. This person or group remains anonymous, as all attempts to uncover Nakamoto’s identity have failed. Australia native Dr. Craig S. Wrightclaims to be Nakamoto but so far has been unable to prove it. |

| No-coiner | No-coiner is a person who owns no cryptocurrency. Term is typically used to describe a cryptocurrency skeptic. |

| Node | Any computer that connects to the Bitcoin network is a node. A computer that maintains an up-to-date copy of the blockchain and is able to verify all the rules of a cryptocurrency is a full node. To run a full node requires a copy of that cryptocurrency’s network software. Any type node can also serve as a wallet. |

| OTC Trades | Over-the-counter (‘OTC’) trades are how many high-net-worth individuals and institutional investors make their especially large trades: they use a broker who directly connects them with an entity willing to buy or sell the asset in question at a particular price. This is intended to avoid losing money by executing a trade so large that it moves the market. |

| Paper wallet | Paper wallet is piece of paper that contains a private key and a Bitcoin address. Somewhat of a misnomer since a paper “wallet” can’t actually store any cryptocurrency. |

| Peer to Peer | Peer to Peer (P2P) refers to the decentralized interactions between two parties or more in a highly-interconnected network. Participants of a P2P network deal directly with each other through a single mediation point. |

| Penny-jumping | Penny-jumping is a strategy used to front-run large orders, typically executed by trading bots. For example, if a trader issues a large BTC buy limit order at $5,000 per coin, then the bot may place an order at $5,000.01. If the price of BTC goes down, it sells back to the big buy order. But if the price of BTC rises, the bot’s order fills above the big order on the order book and can sell at a profit if the big order is re-entered at a higher price. |

| Polar Bear Trades | Polar bear trades are designed to optimize the price on large orders. It is a hidden order that automatically trades on the top of an order book once a set limit price is reached. It’s best used with thin spreads and small quantities on the top of the order book. |

| Pool | As part of bitcoin mining, mining “pools” are a network of miners that work together to mine a block, then split the block reward among the pool miners. Mining pools are a good way for miners to combine their resources to increase the probability of mining a block, and also contribute to the overall health and decentralization of the bitcoin network. |

| Post-Only Order | Post-only orders are something like the opposite of an FOK order: They are accepted only if they do not immediately execute. This prevents the order from taking liquidity out of the market, and it typically allows traders to earn some kind of rebate or fee associated with acting as a market maker. |

| Pre-sale | A sale that takes place before an ICO is made available to the general public to participate. |

| Private key | Private key is a very long password used to unlock your cryptocurrency so you can withdraw it from your wallet to spend, sell, or send to another address. Losing or forgetting your private key means permanently losing access to your crypto. Anyone who gains access to your private key can steal your cryptocurrency. |

| Proof of Authority | is a consensus mechanism in a private blockchain which essentially gives one client (or a specific number of clients) with one particular private key the right to make all of the blocks in the blockchain |

| Proof of stake | Proof of stake is an alternative system for securing a network and maintaining a blockchain. In proof of stake, users put up collateral tokens of a crypto (their “stake”) in return for becoming a “validator” of its blockchain – the same function as miners in a proof-of-work system. For each block, the network chooses a validator at random to record and verify the data. The chosen validator earns fees for performing that task; the larger the stake, the higher the odds of being selected to validate a block. Ethereum has plans to move to a proof-of-stake system. |

| Proof of Work (PoW) | A consensus distribution algorithm that requires an active role in mining data blocks, often consuming resources, such as electricity. The more ‘work’ you do or the more computational power you provide, the more coins you are rewarded with. |

| Protocols | sets of formal rules describing how to transmit or exchange data, especially across a network |

| Pseudonymous | Most cryptocurrencies, including Bitcoin, are only partly anonymous. Because a cryptocurrency address is simply long string of numbers and letters, it offers some level of privacy. But it is often possible, with some effort, to link those addresses to individuals. Privacy-oriented cryptocurrencies such as Monero have additional code to make it virtually impossible to link addresses to individuals, and are considered truly anonymous. |

| Public Address | A public address is the cryptographic hash of a public key. They act as email addresses that can be published anywhere, unlike private keys. |

| Public key | Public key is the wallet address – the alphanumeric string of letters and numbers – you give to others in order to receive cryptocurrency. |

| Pump and Dump | While “pump and dump” is technically a strategy, it’s better identified as a kind of fraud. This is the term for when someone uses false or misleading news or information to artificially pump up an asset’s price so they can dump the asset for a profit before it crashes back down to earth. Anyone can be guilty of this, by the way — not just big institutions or high-net-worth individuals. The next time someone recommends a cryptocurrency you’ve never heard, ask yourself: “Why might this person be trying to get me to buy this?” Sure, they might believe in the cryptocurrency’s value proposition, but they also might be running a good old-fashioned pump and dump. |

| Put Options | A put option is a contract that gives its holder the right (not the obligation) to sell a specific amount of a given asset within a certain time frame. As the underlying asset depreciates in value, the put option itself appreciates; therefore, buying put options on an asset like BTC is a method of shorting it. |

| REKT | RECT is a phonetic spelling of “wrecked.” This term was borrowed from the online gaming community, where it describes a person who suffered an especially bad beat. In cryptocurrency, it means a severe financial loss: “When Bitcoin crashed in 2018, I got REKT.” |

| Resistance | Resistance, typically mentioned in reference to technical analysis, is a price level at which the selling pressure on an asset is historically greater than the buying pressure, meaning that the asset encounters “resistance” from the market when it attempts to break through that price level. One basic tactic of day trading is shorting an asset when the asset is nearing a resistance level and the trader expects it won’t break through the resistance level. Once an asset does break through a resistance level, that level often turns into a support level. |

| Return on Investment (ROI) | The ROI, typically expressed as a percent, is a measure of the efficiency of an investment. For example, if you bought 1 BTC for $6,000 USD and sold it a month later for $6,600 USD, your ROI (ignoring fees, for simplicity’s sake) would be $600 USD / $6,000 USD = 10% in 1 month. |

| Ripple | Ripple or XRP is a source of constant confusion outside of the crypto community (and sometimes within it). Ripple is the company that created the XRP cryptocurrency in 2012. It incorporates XRP into its business of facilitating payments between financial institutions. But XRP should not be referred to as “Ripple,” which is a common mistake. And XRP advocates will call you out on it. |

| Risk On, Risk Off (RoRo) | Risk on, risk off (RoRo) trading is a style of trading according to which you modulate your risk appetite in response to the perceived level of risk in the overall market or economy: When the general cryptocurrency market seems especially risky, you make (relatively) less risky investments (e.g., holding Bitcoin); when the general cryptocurrency market seems less risky, you make (relatively) riskier investments (e.g., trading other tokens). |

| Satoshi | Satoshi is the smallest unit of Bitcoin. One satoshi is equal to 0.00000001 bitcoins (one hundred-millionth of a bitcoin). Also referred to as “sats” for short. Named in honor of Bitcoin’s creator, Satoshi Nakamoto. |

| Scamcoin | Scamcoins are cryptocurrencies with no real purpose other than to fool investors, thus enriching the coin’s creators at the expense of the investors. Most often found among ICOs. Sometimes used derisively by crypto enthusiasts for a coin they dislike, regardless of whether it is an actual scam. |

| Security token | Security token is a cryptocurrency backed by an asset such as gold, real estate, or other investable assets such as ETFs. A security token must comply with the Howey test. Allows for a single physical asset to be subdivided digitally among many owners (one gold could be split into 100 security tokens owned by 100 different people). The initial sale of this variant is called an STO (security token offering). Considered a safer, better-regulated alternative to ICOs. |

| Segregated Witness (SegWit) | The process where the block size limit on a blockchain is increased by removing digital signature data and moving it to the end of a transaction to free up capacity. Transactions are essentially split (or ‘segregated’), into two segments: the original data segment and the signature (or ‘witness’) segment. |

| SegWit | Segwit is a portmanteau of the phrase “segregated witness,” a technology introduced to the Bitcoin protocol in July 2017. By changing how the data is stored, SegWit makes it possible to squeeze more transactions into each Bitcoin block, thus helping to address Bitcoin’s scaling problems. SegWit also fixed an issue called transaction malleability, which opened the door to second-layer technologies such as the Lightning Network. |

| Sell Wall | Sell walls are a large number of sell orders, typically placed on the order book all at once, at a seemingly undervalued price. The standard explanation for sell walls is that a group of rich individuals is manipulating the market to drive down an asset’s price before it takes on a large position in it. Here’s how that explanation goes: A group of high-net-worth individuals (HNWIs) all want to buy a particular cryptocurrency, but they don’t want to move the market with a large order because that will end up making them pay a premium for their trade. Therefore, each member of the group buys only a small fraction of the position they ultimately want to take (e.g., 100,000 of the cryptocurrency rather than 500,000), and then they all simultaneously flood the market with under-priced sell orders. Because the market is flooded with so much selling volume, the buying pressure can’t eat through the wall quickly enough — and anyone who wants to liquidate their own positions in this cryptocurrency will now have to sell at a price lower than that of the sell wall. This drives down the cryptocurrency’s price further, to a point at which the group of HNWIs feels comfortable buying the quantity they initially wanted. Once they’ve done so, they remove the sell wall — and the price of the cryptocurrency rises accordingly. |

| Sharding | Sharding is a process of slicing up a large blockchain into smaller pieces to make it easier for the network’s nodes to manage. Instead of each node storing the entire blockchain, it need only process a part of it. Sharding allows less powerful computers to participate in a cryptocurrency network and aids scaling. Sharding is expected to be implemented on the Ethereum network by 2021. |

| Shilling | Shilling is similar to the pump-and-dump strategy, shilling refers to the act of disingenuously spreading potentially false news about an asset in which one has a vested interest. This is particularly prevalent and problematic in spaces like Reddit and Facebook, which are intended to be spaces where individuals share content that genuinely interests them: It’s easy for a shoddy crypto company to set up a bunch of Reddit accounts to advertise their brand by posing as interested individuals on crypto-related subreddits and submitting links to that crypto company’s content. That’s one of the reasons why you should take market sentiments expressed on forums with a grain of salt. |

| Silk Road | Silk Road is an online market on the dark web (invisible to search engines like Google) that the FBI shut down in 2013. On Silk Road, people could use Bitcoin to buy and sell legal products as well illegal drugs. |

| Slippage | Slippage refers to the difference between the price at which a trader expects a trade to execute and the price at which it actually executes. There are a number of reasons why slippage would occur — for instance, if a trader places a market order when the market is especially volatile, or when a trader places a trade large enough to move the market. |

| Smart contract | Smart contract is a “self-executing” contract that uses cryptocurrency as both the defining and the enforcement mechanism. The contract executes when the software determines that the conditions set forth in the code (and agreed upon by the participants) have been met. Once executed, the smart contract is recorded as part of that cryptocurrency’s blockchain database – thus creating a permanent record of the contract. |

| Smart Routing | A smart order router is a software program that uses algorithms to maximize trading profits by picking the best opportunities on different exchanges. |

| Sniper Trades | Sniper trades are a hidden order optimized for speed. This algorithm is ideal for getting the best possible price on a large order quickly, as you would want to do when the markets are especially volatile and you’re worried about prices dropping drastically. |

| Soft cap | A soft cap is typically a lower limit, more like how much a team is aiming to raise |

| Stable coin | “Stable coin” is a term used in cryptocurrency to describe cryptocurrencies meant to hold stable values. |

| Stablecoin | Stablecoin is a cryptocurrency designed to have constant value relative to some other asset or group of assets. Most stablecoins are pegged to the U.S. dollar, though some are pegged to gold or other commodities. In theory, the administrators of a stablecoin should hold an amount of the pegged asset equal to the value of all the units of that stablecoin. So if there are 10 million units of a stablecoin backed by the U.S. dollar, the administrators should have $10 million in an account to back it. |

| Stop-Loss order | A stop-loss order is a trade that you put in place for an exchange to immediately execute if an asset reaches a particular price point. As the name suggests, this kind of order is designed to limit your losses: if you’re invested in Bitcoin and want to make sure you don’t lose too much money in the event of it tanking, you can make a stop-loss order to ensure that your Bitcoin will be sold immediately if the price dips below a certain point. |

| Support | A support is typically discussed in terms of technical analysis: It’s a price level at which the buying pressure on an asset is historically greater than the selling pressure, meaning the asset encounters “support” when its price attempts to dip lower than that level. A basic method when attempting to secure profit, especially in a volatile market like crypto, is to buy into a cryptoasset when it’s around a level of support and the trader expects that the support will hold. Once an asset does break through a support level, that level often turns into a resistance level. |

| Swing Trading | Swing trading is the strategy of buying an asset at a low price and selling it at a high price at a relatively high frequency — typically once a day or once every few days. The high volatility of many cryptocurrencies has led many traders to focus on this kind of strategy, though that high volatility can also make the strategy costly if you time your trades poorly. |

| Take-Profit Order | A take-profit order is the “other half” of a stop-loss order: whereas a stop-loss order is put in place to limit one’s losses, a take-profit order is put in place to secure one’s profits. When this kind of limit order is put in place with an exchange, you will automatically sell the asset in question, immediately, if its value reaches a certain price. |

| Technical Analysis (TA) | Technical analysis (TA) is a trading strategy that emphasizes using mathematical patterns and indicators to predict where an asset’s price will go in the future. Some focus on TA to the exclusion of all else, reading charts without reading any actual market news, though this isn’t recommended. |

| Token | Token is the actual “coin” of a cryptocurrency. There are three basic types: a utility token, which provides access to a product or service offered by the company that created it; a security token, which represents an asset; and an equity token, which represents ownership in a company (like a share of stock does). |

| Transaction fee | Transaction fee is payment associated with a cryptocurrency transaction. Fees usually go to those who maintain the network (in the case of Bitcoin, miners get the fees). Fees can vary widely depending upon the cryptocurrency, but are usually very small. |

| Trustless | Trustless is quality of most cryptocurrencies in which no party need trust another, a product of having no central authority. With crypto, the network processes a transaction and writes it into the blockchain (the digital ledger) for all other nodes to verify. This eliminates the need for a trusted third party such as a bank to process and verify transactions. |

| Turing complete | Turing complete is a programmable system capable of solving any computational problem. Some cryptocurrencies, such as Ethereum, are considered Turing complete – programs (known as Dapps) can be executed on the network itself. |

| TWAP Trades | Time-weighted average price (‘TWAP’) trades are like a more sophisticated method of dollar-cost averaging. These trades allow you to specify n, t, and p such that you buy or sell n of a cryptocurrency over t hours for an average price of p. |

| Universal 2-Factor (U2F) | A universal 2-factor (U2F) is a sort of specialized, encrypted USB drive that you insert into your computer as a method of 2-factor authentication. At the moment, YubiKey is one of the leading U2Fs available. |

| Utility token | Utility token is a type of cryptocurrency token designed to provide access to a particular product or service offered by the company that created it. |

| UTXO | UTXO is an unspent transaction output – how a network tracks cryptocurrency ownership. Each time a person receives crypto into their wallet, it creates a new UTXO in that amount. All of the UTXOs in a wallet, and the amounts of crypto they represent, adds up to how much crypto that wallet holds in total. |

| Value at Risk (VaR) | Value at risk (VaR) is a statistical method of measuring a portfolio’s risk: It’s the maximum amount of value that one could expect to lose over a given time horizon. For example, if your crypto portfolio has a “95% 2-week VaR of $100,000 USD,” that means that there is 95% confidence, statistically speaking, that your portfolio will not lose more than $100,000 USD of value over the next two weeks. |

| Ver, Roger | Roger Ver is one of the earliest investors in Bitcoin, Ver became a tireless evangelist for the cryptocurrency and earned the nickname “Bitcoin Jesus.” Since siding with the faction that advocated for the Bitcoin Cash fork in 2017, Ver has maintained that Bitcoin Cash is the “real Bitcoin.” |

| Volatility | Volatility is the size of changes in an asset’s value over time. If an asset’s value frequently fluctuates to a great degree — that is, if it’s highly volatile — then it’s typically thought to be a proportionately high-risk investment. The historically high volatility of Bitcoin is one of the reasons why some have been sceptical of Bitcoin’s capacity to act as a store of value. Volatility is also what gives traders the opportunity to profit through day trading and swing trading (see below). |

| Wallet | A file that houses private keys. It usually contains a software client which allows access to view and create transactions on a specific blockchain that the wallet is designed for. |

| Wallet | Wallet is a software program or hardware device that receives and stores cryptocurrency. Moving or spending the stored crypto requires the user have their private key. See hot wallet, hardware wallet, paper wallet, cold storage. |

| Whale | “Whale” is a colloquial term for the biggest players in the cryptocurrency trading game — these include not only HNWIs but also large institutional investors, such as hedge funds. It’s thought that whales are often responsible for atypical market phenomena, such as buy walls and sell walls. |

| White paper | White pater is a document prepared by a developer team to describe the purpose, structure, and roadmap of a proposed cryptocurrency. Typically used to entice investors into a new project. |

| Whitelist | A list of registered and approved participants that are given exclusive access to contribute to an ICO or a pre-sale. |

| Winklevoss, Tyler & Cameron | Tyler and Cameron Winklevoss are twins who became known for suing Mark Zuckerberg for stealing the idea for Facebook from them while all three attended Harvard University. The “Winklevii” invested part of their $65 million settlement into Bitcoin, and have since founded a crypto-related enterprise, the Gemini Exchange. Their Bitcoin holdings are believed to exceed $1 billion. |

| Wright, Dr. Craig S | Craig Wright is an Austrian-born computer scientist who claims to be Bitcoin‘s creator, Satoshi Nakamoto. However, Wright has failed to prove that he has control of any Bitcoin that Nakamoto is known to have mined. Wright remains a controversial figure who also helped drive the creation of the Bitcoin “Satoshi’s Vision” (BSV) hard fork, which he maintains is the “real Bitcoin.” |